Transparent, aligned partnerships We build lasting relationships with our partners based on transparency, ensuring all stakeholders are aligned and working towards a common goal.

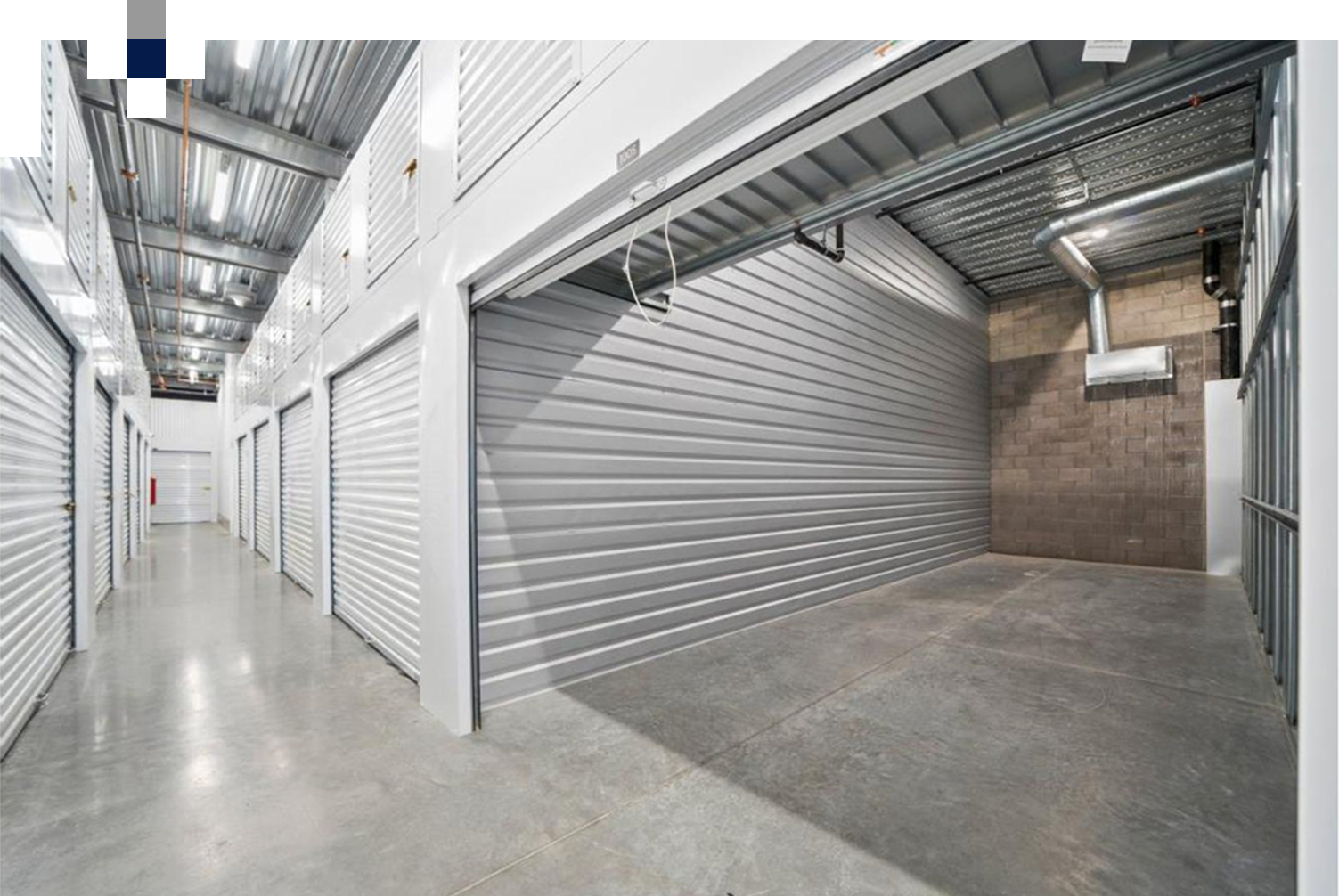

RBS partners with third party management platforms, including Extra Space Storage, to ensure a seamless lease-up and best-in-class customer service.

We identify high-growth markets and develop storage facilities that meet the needs of today’s consumers and investors.

Our hands-on operational management ensures optimal performance, streamlined processes, and enhanced customer satisfaction.

We offer tailored consulting services to help clients make strategic investments, optimize operations, and enhance long-term value.

We prioritize steady income and capital appreciation, creating opportunities for investors to benefit from strong, consistent returns.

Red Balloon Storage (RBS) is a vertically integrated self storage investment, development, and acquisition firm. Since 2017, we’ve acquired and developed over 1 million square feet of institutional-grade storage in high-growth U.S. markets. Our approach blends data-driven insights, on-the-ground execution, and long-term strategic partnerships.

Transparent, aligned partnerships We build lasting relationships with our partners based on transparency, ensuring all stakeholders are aligned and working towards a common goal.

Data-driven decision making We leverage advanced data analytics to guide our investment strategies, making informed decisions that maximize returns and minimize risk.

Boots-on-the-ground submarket analysis Our team conducts comprehensive on the ground research to ensure we are capitalizing on the most promising submarkets, identifying opportunities others might overlook.

Type: Development – Completed

Ground-up development over 90K+ SF taken full cycle. Acquired by Extra Space after 3 years for 3.7X Equity Multiple.

Highlight: Leased out within months

of completion

Type: Value-Add – Completed

Acquired and stabilized the asset. Developed a second phase and sold at 2.7X equity multiple after 2 years of investment.

Highlight: Achieved 40% occupancy

growth in 6 months.

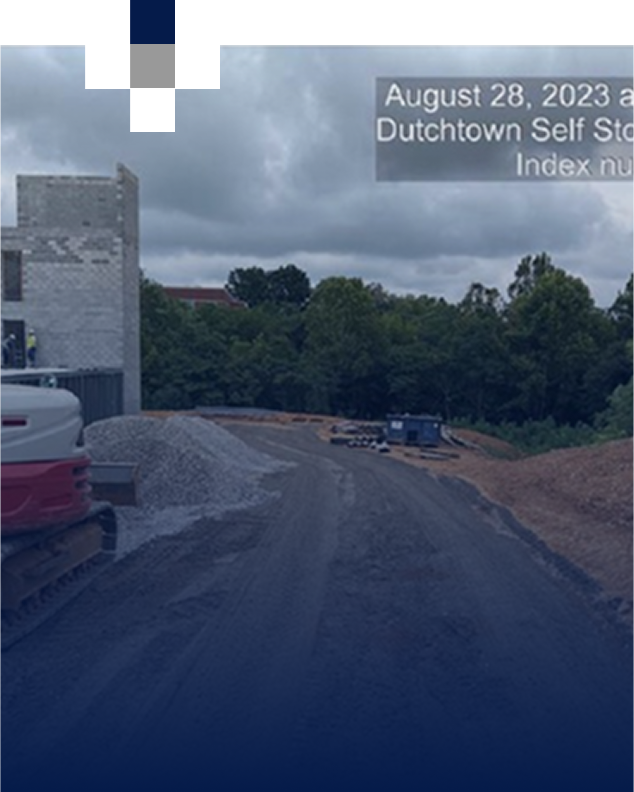

Type: Under Construction

First ground-up development from RBS Fund I LP in a high-growth market in the Tampa MSA. Completion expected in 1Q 2026

Highlight: Completion expected

in Q4.

Type: Development – Completed

Highlight: Leased out within months

of completion

Through our closed-end fund and strategic joint venture structures, we collaborate with capital partners to execute disciplined investments and maximize value.

865-803-8107

IR@RBStor.com

3715 Northside Pkwy

NW, Atlanta, GA 30327.

Sign up to searing weekily newsletter to get the

latest updates.

Copyright © 2025. | All Rights Reserved